David Sutton

Staff Reporter

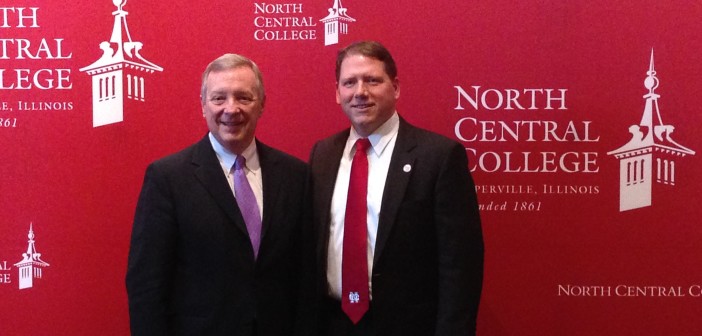

U.S. Sen. Dick Durbin visited North Central College on May 16 to discuss a new bill, the Bank on Students Emergency Loan Refinancing Act, which would allow for the refinancing of student loan debt to match the rates currently offered to new student loan borrowers.

The Democratic senator from Illinois met for a roundtable discussion with President Troy Hammond; Dean of Financial Aid, Marty Rossman, as well as seven North Central College students and alumni.

The bill, which was introduced earlier this month by U.S. Sen. Elizabeth Warren, D-Mass., and co-sponsored by U.S. Sen. Jack Reed, D-R.I., along with Sen. Durbin, aims to help students who are borrowing with interest rates above 7 percent refinance to fewer than 3.86 percent.

“This is a big issue for our economy,” said Sen. Durbin, who has also authored the Student Loan Borrower Bill of Rights Act. “Students are getting so deeply in debt that they will never be able to pay it back – and thedon’t know it.”

“This is a big issue for our economy,” said Sen. Durbin, who has also authored the Student Loan Borrower Bill of Rights Act. “Students are getting so deeply in debt that they will never be able to pay it back – and thedon’t know it.”

Sen. Durbin continued by highlighting that student loan debt now tops $1.2 trillion, which is second only to mortgages and higher than the amount owed nationally on credit cards.

The proposed bill allows borrowers with federal FFEL loans or Direct Loans taken before July 1, 2013 to refinance into the lower 3.86% rate for Undergraduate Direct Loans, 5.41% for Graduate Loans, and 6.41% for PLUS Loans taken out by a student’s parent.

These rates would match interest rates available to new student loan borrowers based on the “Bipartisan Student Loan Certainty Act,” which was passed by Congress last summer.

According to Sen. Durbin, private loans make up a large part of the problem because they usually are attached to higher interest rates. “Schools need to tell students their choices. Students are steered towards private loans and it’s a colossal mistake.”

Rossman agreed but suggested North Central doesn’t follow that route. “I think it’s a big challenge for all of us. We’re trying to help students finance their education and there’s a fine balance between taking on too many loans. We spend a lot of time with students exploring their options with private loans being the very last step.”

“One thing that is impacting me is that this is our first opportunity to establish credit but it’s difficult with interest rates as high as they are,” says Alex Pirela ‘13. “The majority of my loans have interest rates about 6%.”

Class of 2010 alum, Casey Graham Barrette echoed Pirela’s statement before sharing her own story of how student loan affects her and her new family.

College undergrads also voiced their stories. North Central junior, Anthony Schullo, says, “Student loan debt makes it an interesting situation for upcoming graduates. Taking (my student loan debt) into account, I’m also looking at grad programs.”

Graduate school programs can significantly increase the amount of student loan debt one can accrue.

“You can borrow up to $120,000 in student loan debt, including grad school. However, the Graduate PLUS Loan pretty much offers unlimited borrowing potential with a higher interest rate,” says Rossman.

The bill hopes to curb the amount of defaulters on student loan debt by making it easier for graduates to make payments. 6.2% of North Central graduates have defaulted on their loans, which is lower than the national average.

“The bad news is that this costs money,” says Durbin. “Even though we are refinancing at lower interests, there’s money associated.”

The legislation plans to receive its funding by enacting the Buffett Rule, which is named after billionaire Warren Buffett, and limits special tax breaks for wealthiest Americans. These tax breaks allow millionaires and billionaires to pay lower effective tax rates than middle class families. The extra money received by revoking these tax breaks would fund the refinancing of student loan debt.

Sen. Durbin concluded the discussion by mentioning the responsibility institutions have in keeping tuition costs low. “Many colleges have a sticker price for education, which isn’t the real price paid. So you look at the net price. The thing that troubles me is that the real price is going up dramatically faster than real incomes.”

For more information on student loans, be sure to check out the Financial Aid page on the College’s website, as well as keeping an eye on your loans with the tuition calculator available on Merlin.